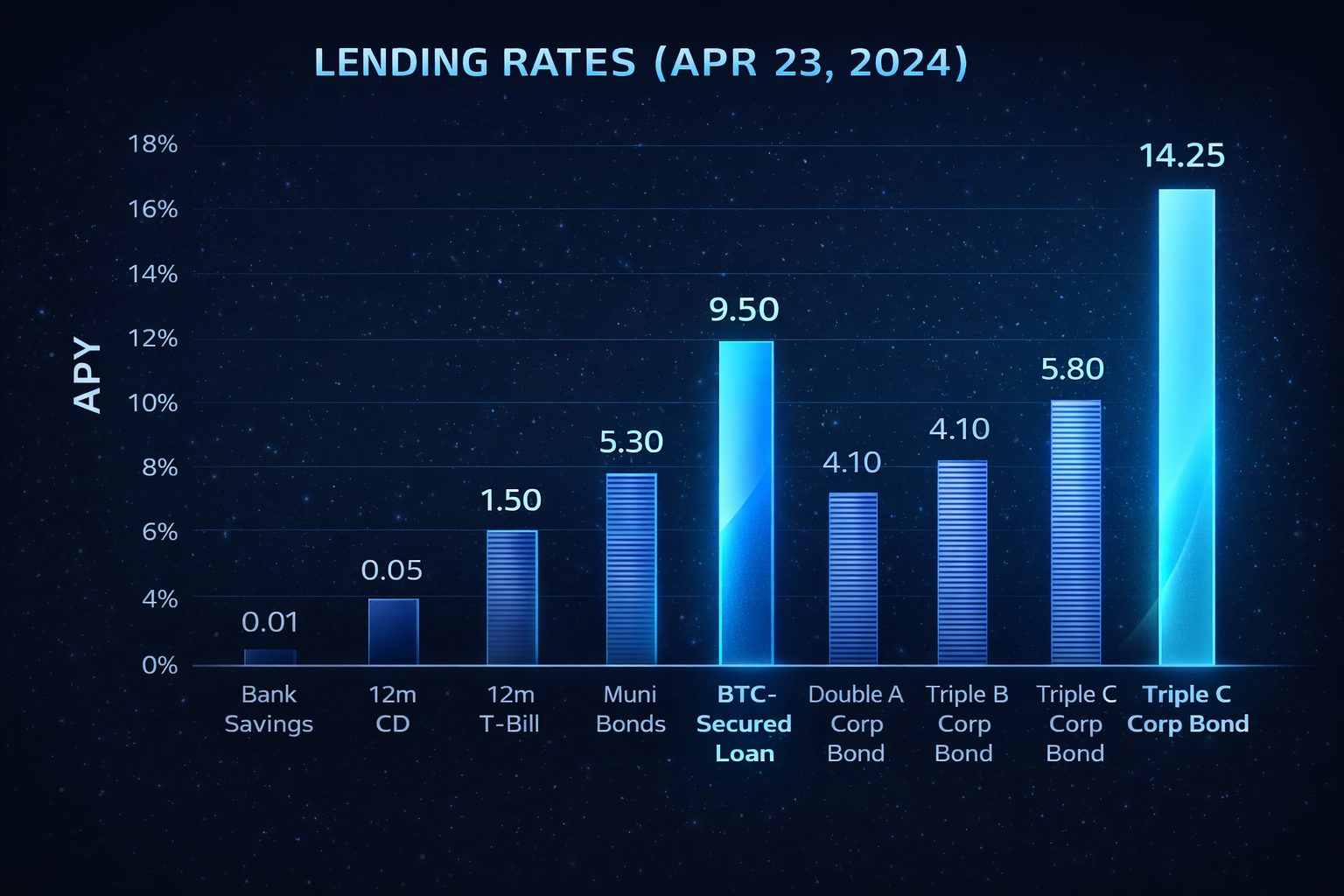

Earn the best risk-adjusted Fixed income yields ever with near-zero default risk

Security-obsessed Bitcoiners are paying higher yields due to limited options currently

Get StartedLender Services

Long-term Indian Bitcoin holders represent nearly $50 Billion of unrealized gains. Unlike all other cryptocurrencies, Bitcoin has the most liquid market, the lowest volatility, and most time-tested and mature protocol.

With Valuete Marketplace, you are granted access to vetted Borrowers seeking INR-nominated loans that are overcollateralized with their Bitcoin holdings. Hard LTV limit-triggers are in place to quickly alert and address the borrower of any adverse LTV conditions; and if necessary, to automatically commence the liquidation process far ahead of any highly unlikely lender loss. We encourage our users to borrow within your means as well as theirs. As backstop, the loan and the conditions associated with the collateral are all 100% enforced by local law.

To get started, simply seek a borrower on the Marketplace that fits your investment thesis and connect using the Valuete web portal to start the loan process. Note, for regular non-professional Lenders, Valuete provides all the templates for loan and security agreements used to initiate the loan process.

Get Started

Why Settle for Moderate Returns with High Default Risk?

Traditional BBB-rated corporate bonds in India offer 8–12% annual returns, but come with issuer default risk, poor recovery rates, and weak liquidity. Investors are often exposed to delays, legal battles, and uncertain outcomes when issuers face stress.

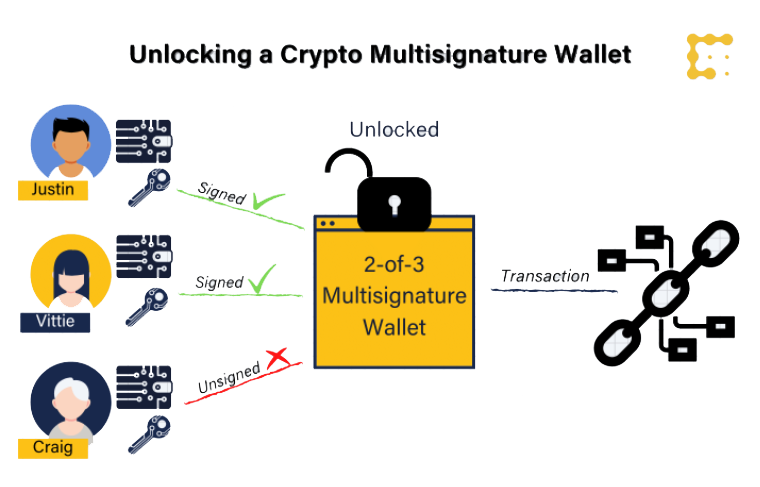

Bitcoin-backed lending offers a more secure alternative: Fully collateralized loans using 3-of-4 multisig escrow, transparent custody, and automated collateral protection via LTV monitoring.

Returns Comparison

| BBB-Rated Bonds | Bitcoin-Backed Lending | |

|---|---|---|

| Expected Returns | 8%–12% per year | 12%–20%+ per year |

| Risk Basis | Depends on the issuer's solvency | Fully collateralized loan |

| Liquidity | Low — hard to exit early | Collateral liquid on global markets |

| Transparency | Limited disclosures | On-chain verifiable multisig custody |

Risk Comparison

| BBB-Rated Bonds | Bitcoin-Backed Lending | |

|---|---|---|

| Default / Credit Risk | Moderate to high; recovery uncertain | Collateral liquidated if LTV breached |

| Collateral Quality | Often unsecured | BTC collateral held securely in escrow |

| Price / Market Risk | Bond price drops if rates rise | BTC price volatility managed with LTV triggers |

| Counterparty Risk | Issuer failure/rating downgrade | Distributed control via 3-of-4 multisig |

| Recovery Time | It can take years in bankruptcy courts | Minutes–hours via automated liquidation |

The Bottom Line

BBB-Rated Bonds = Lower returns + higher issuer risk + slower recovery

Bitcoin-Backed Lending = Higher returns + real collateral + faster protection

The future of secure yield is collateral-first lending, not unsecured corporate credit.

How Valuete Works for Lenders

Valuete is a non-custodial marketplace for bitcoin-backed loans, powered by 3-of-4 multi-sig wallets and 200% over-collateralisation. You lend into legally-enforced, asset-backed contracts; borrowers lock more than enough BTC into multi-sig escrow before any funds move.

Your capital, our infrastructure

- You choose offers by yield, term, and risk profile.

- Borrowers deposit BTC collateral into a dedicated multi-sig address, visible on-chain at all times.

- Contracts define LTV thresholds, margin calls, and liquidation rules up front, with smart monitoring and alerts.

- You receive principal + interest at maturity or earlier if the borrower repays, with collateral as your downside protection all the time.

Why Lend with Valuete?

Higher, More Efficient Yield

Target 12–16% p.a. on secured BTC-backed loans, significantly outperforming the 5–7% typical of FDs and bonds, while still retaining full upside potential to any long-term Bitcoin price appreciation.

Non-Custodial Multi-Sig Security

Collateral sits in a 3-of-4 multi-sig wallet shared between lender, borrower, Valuete, and an independent key partner. No single party can move funds, and every satoshi is traceable on-chain.

Conservative Risk Engine

All loans are over-collateralised (typically 200%+), with clear LTV bands, automated margin-call alerts, and pre-agreed liquidation logic designed to keep you whole even in volatile markets.

Legal and Operational Robustness

Each loan is backed by a digitally-signed, lawyer-vetted contract enforceable in Indian courts, with optional legal support in edge cases and structured dispute-resolution flows.

Full Transparency and Control

Your detailed dashboard provides real-time visibility into live collateral value, LTV ratios, contract status, and payment history. We guarantee no rehypothecation, no opaque pooling, and absolutely no hidden fees.

Fortress Security

Lender security is provided by multiple layers of security built into the Valuate Vault.

Layer 1

Borrower collateral is transferred into a 3-of-4 multi-sig wallet shared between lender, borrower, Valuete, and an independent key partner. Collateral access and control require use by 3 of the 4 keys, eliminating any single bad actor risk. No single party can move funds, and every satoshi is traceable on-chain.

Layer 2

Distributed Class III Offline, Hardware wallets is required by all parties eliminating any risk of online breach

Layer 3

Secure infrastructure, operations, and processes including

- ISO/IEC 27001 Certification

- Community Driven Vulnerability Disclosure & Bug Bounty Program

- 24/7 Security Operations Centres (SOC)

- Immutable audit trails, backups, and retention

- Strong Access Controls, Advanced Data Protection and Crypto Protocols

- Ongoing Risk Assessment, Threat mapping & Auditing

- $150M insurance for third-party theft of private keys in a physical breach of a hardware security module (HSM)

With these layers of Lender protection and pre-set LTV limit triggers on over-collateralized Bitcoin holdings, your loan is nearly free from default and custodial risk.

How It Works

- 01

Onboard & Verify

Begin your journey by creating a secure account and completing the required KYC verification process. Easily link your preferred Bitcoin wallet and bank account to facilitate seamless, automated transfers for funding loans and receiving your returns.

- 02

Select or Create Offers

Explore our marketplace of curated borrower demands to find your ideal match, or take the initiative to publish your own custom lending offers. You have full control to specify the exact loan amount, interest rate, duration, and acceptable LTV ratios.

- 03

Collateral Lock-In

Once a lending match is finalized, the borrower deposits Bitcoin into a unique, secure multi-sig escrow address. You can independently verify this transaction on-chain, ensuring the collateral is safely locked before any capital is released.

- 04

Earn Passively

Upon collateral verification, your funds are securely disbursed according to the contract. You immediately begin earning passive income, accruing interest from day one of the loan term without any need for further manual intervention.

- 05

Repayment or Liquidation

At the end of the term, receive your principal and interest in your chosen currency. If a borrower fails to repay or meet margin calls, the collateral is liquidated per the smart contract to ensure you are repaid, with any surplus returned to them.

Because of the uniqueness of this non-custodial security holdings, we do require using the Valuete security interest agreement to assure appropriate Lender protections.

Who Should Lend on Valuete?

HNIs, Family Offices, and Funds

Ideal for High Net Worth Individuals, Family Offices, and Investment Funds seeking secured Bitcoin credit exposure. Diversify your portfolio with high-yield, asset-backed opportunities that offer superior protection compared to unsecured lending.

Companies

Perfect for corporate treasuries looking to deploy capital efficiently. Secure structured, over-collateralised loans that deliver robust risk-adjusted returns, helping your business optimize idle cash while maintaining strict safety standards.

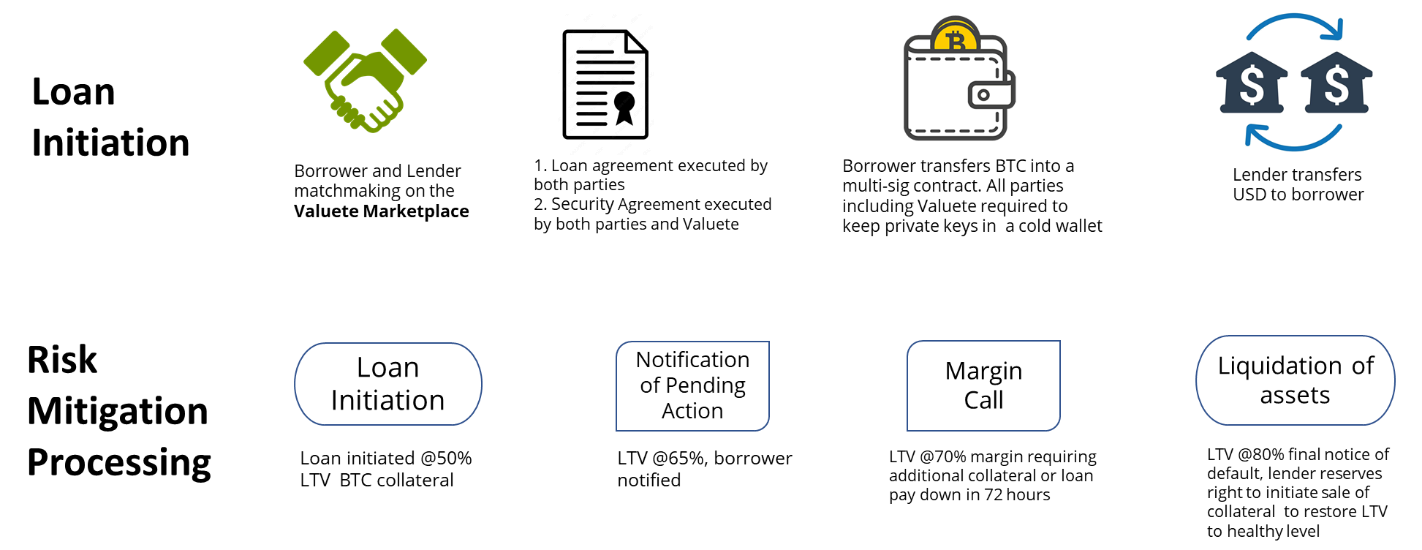

Risk Mitigation Process

We got you covered at each step

Loan Initiation

Loans are initiated with a strong safety buffer at a conservative 50% Loan-To-Value (LTV) ratio. This means for every dollar lent, the borrower deposits twice the value in Bitcoin collateral, ensuring your capital is heavily over-collateralised from day one.

Notification of pending Action

If market volatility pushes the LTV to 65%, our system automatically triggers a proactive notification. This early warning alerts the borrower to the changing health of their loan, giving them ample time to prepare funds or collateral before critical levels are reached.

Margin Call

At 70% LTV, a formal margin call is issued. The borrower is required to restore the loan's health by depositing additional collateral or paying down a portion of the principal within 72 hours, preventing the risk of default.

Liquidation of assets

If the LTV hits 83%, a final liquidation event occurs. To protect lender capital, the smart contract automatically sells a portion of the collateral to restore the LTV to a healthy level, ensuring you are made whole while returning any remaining surplus to the borrower.